Solar Loan vs Lease vs PPA: Which Saves You More?

Compare solar loan vs lease vs PPA options, see who owns the panels, who gets tax credits, and which deal delivers the biggest long-term savings.

When I first started looking at rooftop solar, I thought the hardest part would be picking panels.

Nope.

The real headache was the contracts.

Three companies came out. All three promised “$0 down solar”.

But one pitched a loan, one pushed a lease, and one was obsessed with their PPA (Power Purchase Agreement).

All three companies considered the same sun exposure, roof type, and number of panels.

But totally different answers to questions like:

- Who owns the system?

- Who gets the tax credits?

- What happens when I sell the house?

- And most importantly: who actually saves the most money?

In this post, I’ll walk you through solar loans vs. solar leasing vs. PPAs in plain English, so you can decide which one actually fits your budget, your risk tolerance, and your plans for your home.

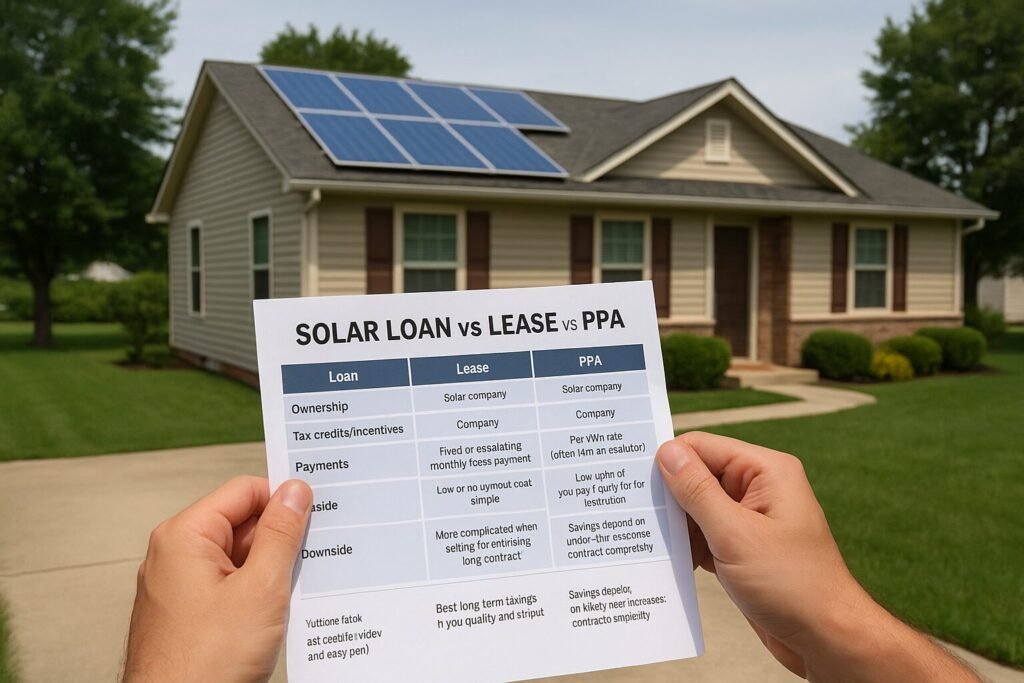

1. Solar Loans vs. Leases vs. PPAs: The Simple Breakdown

Let’s start with quick definitions.

1.1 What is a Solar Loan?

A solar loan works a lot like a car loan or home-improvement loan:

- You own the solar system.

- A bank, credit union, solar lender, or sometimes the installer finances it.

- You make a fixed monthly payment for a set number of years (often 5–20).

- Once it’s paid off, the system is yours, free and clear.

You’re basically swapping your electric bill for a loan payment + a smaller electric bill.

1.2 What is a Solar Lease?

A solar lease is like leasing a car:

- The solar company owns the system.

- You rent the equipment and pay a fixed monthly fee to use it.

- That payment might stay flat or have a built-in yearly increase (called an escalator).

- You usually have a contract term of 15–25 years.

You don’t pay for the power per kWh. You pay to “rent” the panels.

1.3 What is a PPA (Power Purchase Agreement)?

A PPA is different:

- The solar company owns the system, just like with a lease.

- You don’t pay to rent the system. Instead, you pay for the electricity it produces.

- You pay a set price per kWh (for example, a bit less than your utility rate).

- The rate often increases every year by a small percentage unless you negotiate otherwise.

Think of it as switching power providers on your roof rather than at the grid level.

1.4 Quick-Glance Comparison

Here’s the 10-second version:

- Loan

- Ownership: You

- Tax credits/incentives: Usually, you

- Payments: Fixed loan payment, then $0

- Upside: Best long-term savings if you qualify and stay put

- Downside: You take on debt and responsibility

- Lease

- Ownership: Solar company

- Tax credits/incentives: Company

- Payments: Fixed or escalating monthly lease payment

- Upside: Low or no upfront cost, simple

- Downside: More complicated when selling/refinancing; long contract

- PPA

- Ownership: Solar company

- Tax credits/incentives: Company

- Payments: Per kWh rate (often with an escalator)

- Upside: Low upfront, you pay mainly for what you use

- Downside: Savings depend on utility rate increases; contract complexity

2. Who Owns the System—and Why It Matters

Ownership sounds boring, but it affects everything: incentives, resale, control, and long-term savings.

2.1 Ownership with a Solar Loan

With a loan, you own the system from day one. The lender just has a lien or financing agreement, like with a car or home improvement.

That usually means:

- You decide on maintenance and repairs.

- You can add panels later (assuming the roof and inverter allow it).

- The system can be treated as an owned improvement to the property.

2.2 Ownership with a Lease or PPA

With a lease or PPA, the solar company owns the system, not you.

That usually means:

- They are responsible for maintenance and performance under the contract.

- You often can’t modify the system without their permission.

- They decide how and when to upgrade or replace equipment.

2.3 Why Ownership Changes the Math

Ownership decides:

- Who gets the tax credits and rebates?

- How your home value may be affected.

- How easy or hard is it to sell or refinance later?

- Whether your savings can grow over time once the loan is paid off.

If you like the idea of solar being a permanent upgrade to your property that keeps paying you back, ownership (loan or cash) is usually more attractive.

3. Who Gets the Tax Credits, Rebates, and Incentives?

This is one of the biggest surprises for many people.

You don’t automatically get the solar tax credit just because the panels are on your roof.

3.1 Loans: Incentives Usually Go to You

With a loan, you’re typically the system owner, so:

- You’re usually the one who can claim federal tax credits (if you qualify).

- You may also be eligible for state incentives and local rebates.

- Some incentives reduce the effective cost of your system significantly.

You do need enough tax liability to actually use the credit, so it’s worth talking to a tax professional for your situation.

3.2 Leases & PPAs: Incentives Go to the Company

With leases and PPAs, the solar company owns the equipment, so:

- They usually claim the tax credits and incentives.

- In theory, they “pass the savings” to you through lower payments or better terms.

- In practice, you’re trusting their pricing to reflect that.

This doesn’t automatically make leases/PPAs bad, but it does mean you’re not stacking incentives on top of your own long-term ownership.

3.3 Incentives Change the Real Cost Comparison

Two neighbors can have the same system size and the same roof, but:

- Neighbor A buys with a loan and uses tax credits and rebates to lower the total cost.

- Neighbor B signs a lease where the company takes the incentives.

On paper, both got “$0 down.” Over 20–25 years, the financial outcome can be very different.

4. Lifetime Cost and Savings: Who Really Saves the Most?

Everyone loves to show charts with huge savings curves. The tricky part is what assumptions they used.

4.1 Upfront Cost vs. Lifetime Savings

Roughly:

- Loans: You may put some money down or go zero-down. You may have a payment that’s similar to your current electric bill at first. Over time, once the loan is paid off, your savings can increase dramatically.

- Leases/PPAs: Often no upfront cost. You start saving a bit (hopefully) from day one, but you keep paying for 15–25 years.

If you’re planning to stay put and can handle a loan, ownership tends to win on total dollars saved over the long term.

4.2 Typical Patterns

- Solar loan

- Best when you stay in the home long enough to pay off or nearly pay off the system.

- After the payoff, your electric bill is mostly just residual usage and fixed utility fees.

- Solar lease

- It can be nice if you want predictable payments and don’t want to own anything.

- But you rarely get that “my panels are now basically free” feeling.

- PPA

- Attractive when they offer a kWh rate noticeably lower than your current utility rate.

- Savings depend heavily on how your usage and utility rates change over time.

4.3 Utility Rate Assumptions Matter

Many proposals assume your utility rates will skyrocket every year.

If that happens, your savings look huge.

If they don’t, your “guaranteed” savings may disappear.

When you compare loan vs lease vs PPA, always ask:

- What utility rate increase did they assume each year?

- What PPA or lease escalator did they build in?

If the solar payment is rising faster than your actual utility rates, the deal may get worse over time, not better.

5. Monthly Payments and Cash Flow

Most of us live in a monthly payment world, not a lifetime model world. Let’s talk cash flow.

5.1 Solar Loan Payments

With a loan, you’ll usually see:

- A fixed monthly payment for the length of the loan.

- A smaller electric bill because the panels offset some of your usage.

For many people, the goal is a “bill swap”:

Electric bill goes down

- Solar loan payment

≈ About what you were paying before (or a little less).

The big payoff comes later, when the loan is gone.

5.2 Solar Lease Payments

With a lease, you pay:

- A fixed or escalating monthly lease payment, plus

- A reduced electric bill (since you’re still connected to the grid).

Your solar payment might start below your old power bill, but if it escalates every year, that gap can close.

5.3 PPA Payments (Pay per kWh)

With a PPA, you:

- Pay per kWh for the power your system produces.

- Still get a reduced utility bill because you’re buying less power from the grid.

If the PPA rate starts much lower than your utility rate and the escalator isn’t too aggressive, this can produce steady savings. If the rate and escalator are high, your savings may fade.

5.4 Cash-Flow Scenarios

Here’s how I think about it:

- Tight monthly budget, no savings, short time horizon

Lease or PPA might be appealing because of the low upfront cost and simple structure. - Steady income, plan to stay in the home 10+ years, okay with a loan

A loan can give the best balance of reasonable monthly payment + strong long-term savings.

6. Selling Your Home with a Loan, Lease, or PPA

This is the part almost nobody thinks about until it’s too late.

6.1 Selling with a Solar Loan

You usually have two main options:

- Pay off the loan at closing using sale proceeds.

- The buyer gets a home with owned solar and no solar payment.

- Transfer the loan to the buyer (if the lender allows it).

- The buyer takes over the solar payment.

Many buyers like the idea of owning solar, especially if you can show:

- Past electric bills

- Production data

- Warranty information

6.2 Selling with a Solar Lease or PPA

With leases and PPAs, you typically:

- Try to transfer the contract to the buyer, or

- Buy out or prepay the remaining term (if allowed).

Here’s the catch: not every buyer wants to inherit a 20+ year contract they didn’t sign.

If the buyer refuses to assume the lease/PPA, you may need to:

- Pay a buyout amount, or

- Negotiate with the solar company for another solution.

6.3 Tips to Avoid Resale Headaches

Before signing anything, ask:

- How many homes with your contracts have sold in this area?

- What does the transfer process actually look like?

- Is there a buyout schedule in writing?

- Will there be any liens or UCC filings on the property?

If you know you might move in the next 5–7 years, the fine print around resale is just as important as the monthly payment.

7. Home Value and Refinancing

Solar can be a selling point—or a sticking point.

7.1 Owned Systems (Loans or Cash)

When the system is owned (loan paid off, or you plan to pay it off at sale):

- Appraisers may treat solar as a value-adding improvement, especially with good documentation.

- Buyers often see lower electric bills as a big plus.

- Refinancing is usually cleaner when the system is owned or when the loan is just another line of debt.

7.2 Leased or PPA Systems

With a lease or PPA:

- Some buyers like getting lower electric bills without buying the system.

- Others are wary of long-term contracts, escalators, and “one more bill.”

- Lenders and appraisers may treat the system differently from owned solar.

The key is transparency. Have:

- The full contract is ready.

- A clear summary of monthly payments, escalators, and the remaining term.

- Data showing actual savings if you’ve had the system for a while.

7.3 Solar and Refinancing

Depending on how the financing is structured:

- A solar loan may show up as standard debt.

- Some financing uses UCC filings or other mechanisms that your mortgage lender will want to see.

If you know you plan to refinance soon, it’s worth asking both the solar lender and your mortgage lender how a new solar contract or loan will be treated.

8. Escalator Clauses and Utility Rate Risk

This is where a lot of people get burned.

8.1 What is an Escalator Clause?

An escalator is a built-in annual increase in your:

- Lease payment, or

- PPA kWh price.

It might be something like 2–3% per year.

That sounds tiny, but over 20–25 years, it adds up.

8.2 When Escalators Break Your Savings

If your solar payment rises faster than:

- Your utility rates, or

- Your income,

Then long-term savings can shrink or even vanish.

Always ask:

- What is the annual escalator on this contract?

- Could I get a flat-rate option (even if the first-year price is higher)?

8.3 What if Utility Rates Don’t Rise as Fast as Promised?

Many proposals assume very aggressive utility rate increases.

If your utility rates don’t cooperate:

- A lease or PPA with a high escalator can end up more expensive than just staying with the utility.

- A loan with a fixed payment looks better and better over time, because your payment stays flat and the panels keep producing.

Conservative assumptions are your friend. I’d rather be pleasantly surprised than disappointed.

9. Contract Terms and the End of the Line

Solar contracts are long—often longer than car loans and sometimes longer than mortgages.

9.1 Common Term Lengths

- Loans: typically 5–20 years

- Leases: often 15–25 years

- PPAs: often 15–25 years

Equipment warranties and production guarantees may have their own timelines.

9.2 End-of-Term for a Solar Lease

At the end of a lease, you often get choices like:

- Renew the lease (sometimes at a different rate)

- Buy the system (for a set price or fair market value)

- Have them remove the system

Make sure those options (and how the buyout is calculated) are in the contract, not just something the salesperson says.

9.3 End-of-Term for a PPA

PPAs work similarly:

- You might get an option to extend the PPA,

- Buy the system, or

- Have it removed.

Again, the details matter. Don’t rely on “Oh, we’ll work something out.”

9.4 End-of-Term for a Solar Loan

With a loan, the end is simple:

- You make the last payment.

- You own the system outright.

- Panels usually still produce a significant percentage of their original output.

That’s when the real “free-ish power” feeling kicks in.

10. How to Decide: Loan vs. Lease vs. PPA

Here’s the part where we tie it all together.

10.1 Start with Your Priorities

Ask yourself:

- Is my top priority maximum long-term savings?

- Is it the lowest possible upfront cost?

- Is it simplicity and low mental overhead?

- How long do I realistically see myself staying in this home?

10.2 When a Loan Might Make Sense

A solar loan often fits if:

- You have a decent credit score and can qualify for reasonable rates.

- You plan to stay in the home for at least 7–10 years.

- You’re okay with taking on a fixed monthly payment in exchange for owning the system.

- You want to claim tax credits and build home value.

10.3 When a Lease or PPA Might Fit

A lease or PPA might make sense if:

- You want low or no upfront cost.

- Your credit is okay, but you don’t qualify for great loan terms.

- You value simplicity and don’t want to be responsible for equipment.

- You’re okay trading maximum savings for lower effort and less responsibility.

If you go this route, the key is to fight for good terms:

- Reasonable escalator (or none)

- Clear transfer and buyout language

- Transparent end-of-term options

10.4 Red-Flag Situations

Slow down and get more quotes if:

- The salesperson can’t clearly explain who owns the system.

- They gloss over tax credits or refuse to show how they’re factored in.

- You can’t get a straight answer about escalators or end-of-term options.

- You feel rushed, pressured, or told “this deal expires tonight.”

You’re signing a contract measured in decades, not months. You’re allowed to sleep on it.

11. Common Questions Asked by Homeowners

1. What’s the difference between a solar loan, a solar lease, and a PPA?

- Loan: You own the system, pay it off over time.

- Lease: You rent the system for a monthly fee.

- PPA: You pay per kWh for the power the system generates.

2. Which option usually saves the most money long-term?

If you qualify for a good rate and stay in the home, a loan + ownership usually wins over 20–25 years. Leases and PPAs can still save money, but often cap your upside.

3. Who owns the panels under each option?

- Loan: You.

- Lease/PPA: The solar company.

Ownership affects everything from tax credits to home value.

4. Who gets the tax credits and rebates?

- Loan (ownership): Usually, you (if you qualify).

- Lease/PPA: Usually, the solar company.

5. How do monthly payments compare?

- Loan: Fixed payment + smaller electric bill.

- Lease: Fixed or escalating lease payment + smaller electric bill.

- PPA: Pay per kWh at a contracted rate + smaller electric bill.

6. What happens if I want to sell my house?

- Loan: You can pay off at closing or sometimes transfer it to the buyer.

- Lease/PPA: You either transfer the contract to the buyer or buy out/presolve it.

7. How do these options affect home value and refinancing?

Owned systems tend to be cleaner for appraisals and refinancing. Leases/PPAs can add complexity and depend heavily on buyer perception and lender policies.

8. Are there escalator clauses with leases and PPAs?

Often yes. Many leases/PPAs have annual payment or rate increases. You want to know exactly what they are and compare them to realistic utility rate increases.

9. What if utility rates don’t rise as fast as expected?

If your utility rates stay flatter than projected, leases and PPAs with escalators can end up saving less than promised—or even costing more over time.

10. What happens at the end of a lease or PPA term?

You may be able to renew, buy the system, or have it removed. The exact options and prices should be in the contract.

11. How do I choose based on my credit, budget, and time in the home?

- Good credit, long time horizon, want max savings → Loan/ownership.

- Shorter time horizon, minimal upfront cash, okay with long contracts → Carefully chosen lease/PPA.

- Unsure? Get quotes for all three and run side-by-side comparisons with conservative assumptions.

12. Real-World Mini Scenarios

Just to make this more concrete, here are a few common patterns.

Scenario 1: Long-Term “Forever Home” Folks

- Plan to stay 15–20+ years

- Good credit

- Stable income

A loan often makes sense. You get the incentives, build home value, and eventually enjoy years of power with no loan payment.

Scenario 2: Retiree Unsure How Long They’ll Stay

- May move in 5–7 years

- Wants lower bills but doesn’t want more “stuff” to manage

A carefully structured lease or PPA might be okay if the resale and transfer terms are crystal clear and reasonable.

Scenario 3: Budget-Constrained but Wants Solar Now

- Very tight budget

- No savings for upfront cost

- Just wants a lower bill today

A PPA or lease may provide immediate relief without a big cash outlay. The key is to avoid aggressive escalators and understand the long-term trade-off.

13. Wrapping It Up: Don’t Just Pick “$0 Down”—Pick the Right Structure

Solar is one of those things where the hardware is only half the story.

The other half is the contract.

- Loans, leases, and PPAs can all make sense for the right person.

- Ownership (via a loan or cash) usually gives the best long-term payoff, especially if you’ll be in your home for a while.

- Leases and PPAs can be useful tools—but they need extra scrutiny around escalators, transfer rules, and end-of-term options.

If you’re in the middle of quotes right now, here’s what I’d do next:

- Get at least one proposal in each format: loan, lease, PPA.

- Ask each company to clearly spell out: ownership, incentives, escalator, term, transfer rules, and end-of-term choices.

- Run the numbers with conservative utility rate assumptions, not just their rosy chart.